Financial Banking Instruments

Financial instruments are legal agreements or contracts made between institutional entities. These agreements typically involve one party paying money or providing something of value to the other party under specified conditions. In return, the counterparty may receive interest, rights, premiums, or indemnification against risks. A financial asset is any contract that results in a financial claim for one party and either a financial liability or equity participation for another. By making payments, the counterparty expects to benefit from interest, capital gains, premiums, or compensation for potential losses.

A financial instrument can exist as a physical document, like a stock certificate or a loan contract. However, most financial instruments are now stored electronically in a book-entry system, with records maintained by entities such as the Federal Reserve for U.S. Treasuries.

Common Financial Instruments Include:

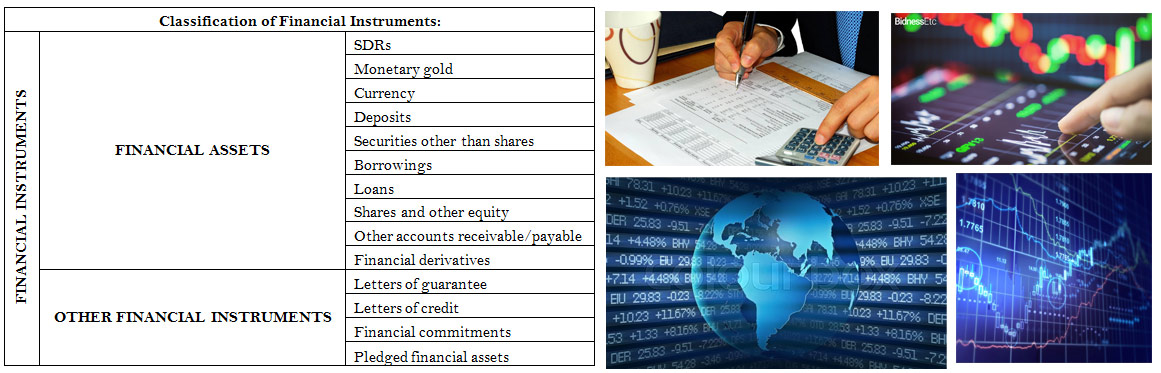

Check: Used to transfer money from the payer to the payee. Stocks: Issued by companies to raise capital from shareholders. Investors purchase stocks, gaining ownership in the company. Bonds: A means for investors to lend money to an issuer in exchange for interest over a specified term.The concept of a financial instrument is broader than that of a financial asset. Financial instruments are classified into financial assets and other financial instruments based on their liquidity and legal characteristics. Many financial instruments are custom agreements tailored to meet the parties' specific needs, while others follow standardized contracts with predetermined terms.

These financial instruments are widely used in the financial sector.

Valuation of Financial Instruments

The value of a financial instrument is determined by its expected return, the likelihood of payment, and the present value of the payment.Generally, the higher the expected return, the greater the value of the instrument. This explains why stocks of fast-growing companies are highly valued.

Financial instruments with lower risk tend to have higher value than those with higher risk. The greater the risk, the lower the instrument's value, as risk requires compensation.

At Global R Metals, we are a trusted partner for clients looking to raise capital for ventures. Whether through debt or equity, and whether for expansion or startup, we provide the expertise and support needed to secure the funding required for success.